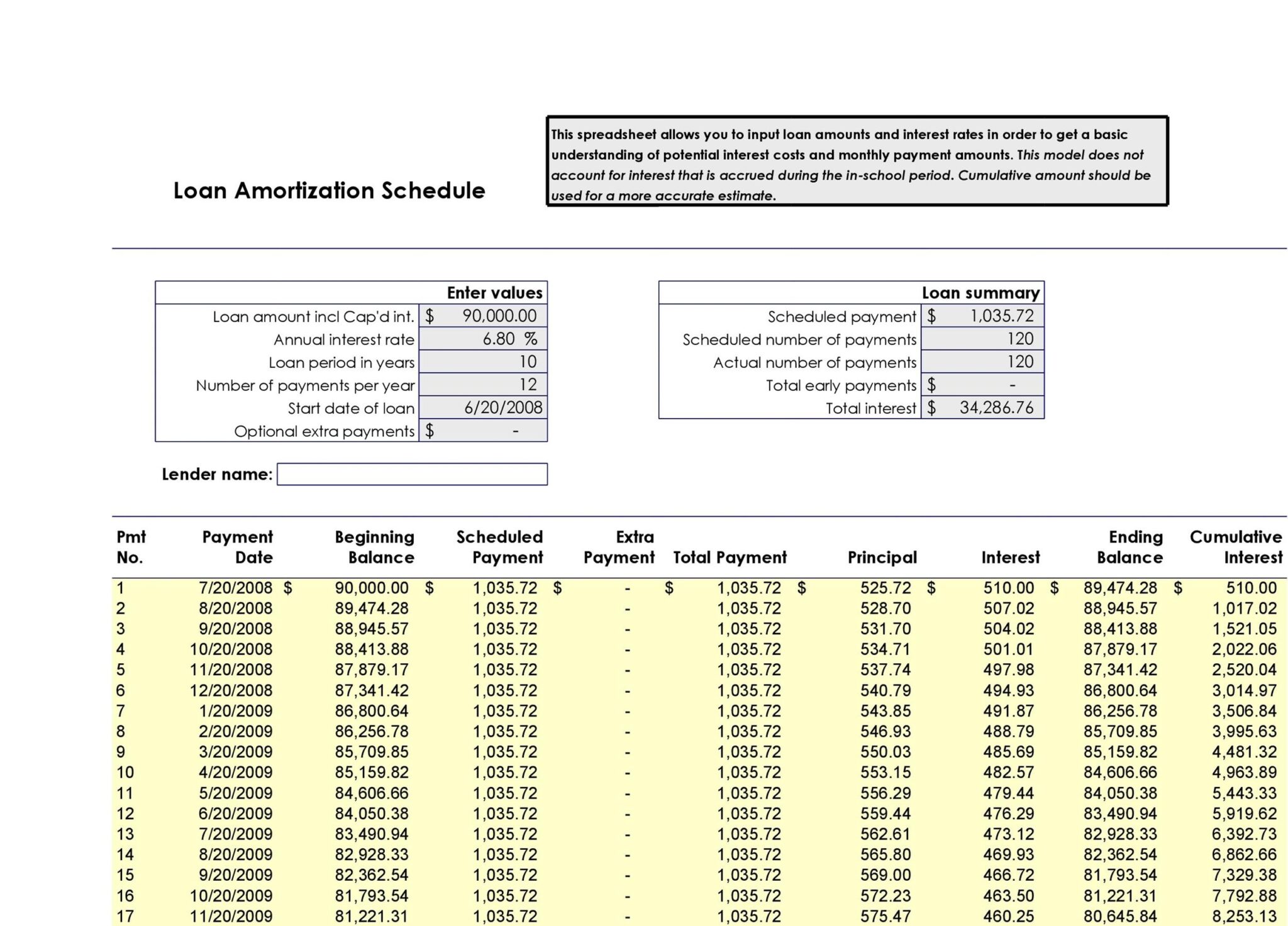

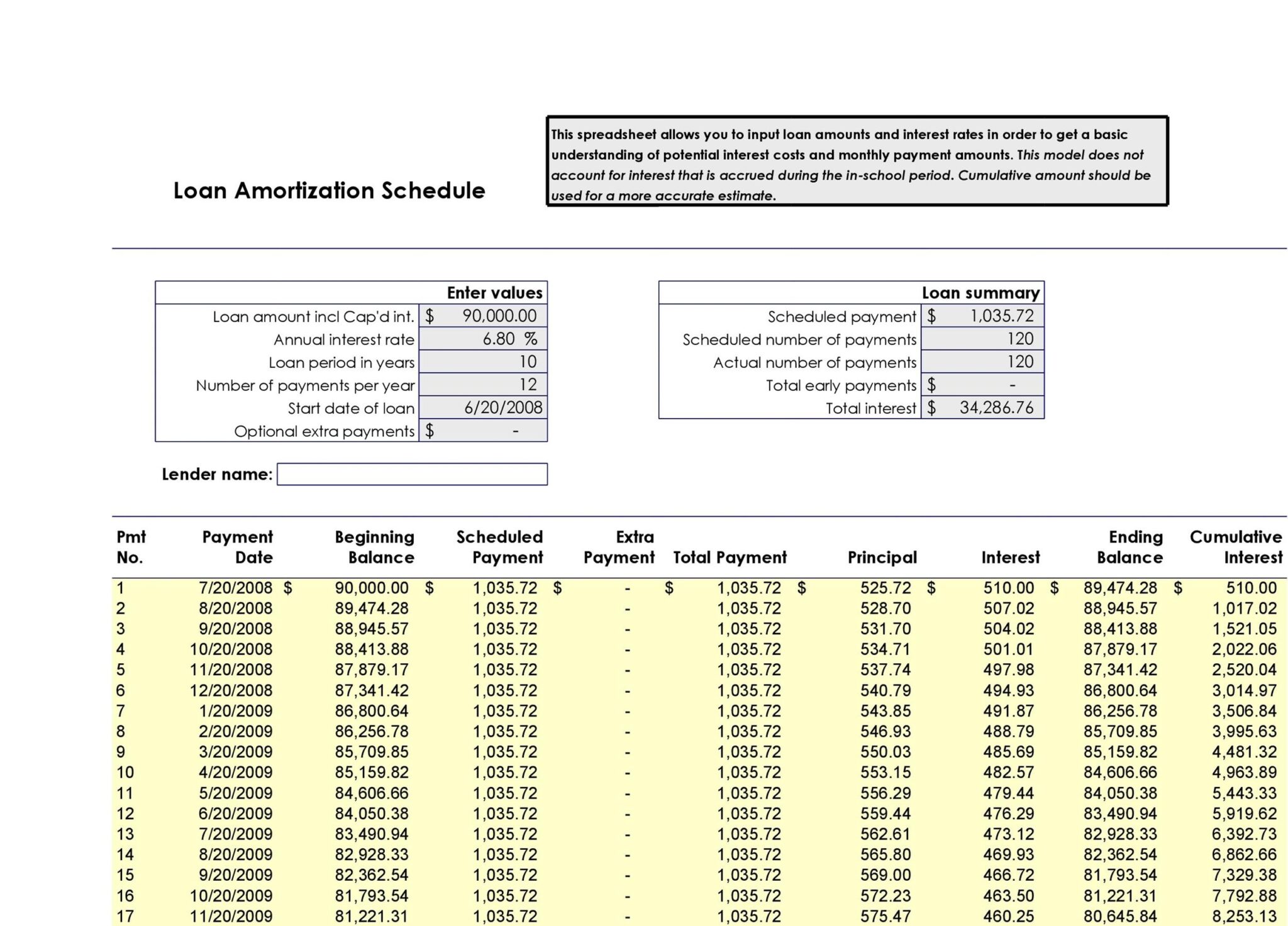

You can see that extra payments have been added in the 19th period (after we are done with a total of 18 payments). We have input all the information in my template. You will input these values directly under the column Extra Payment (Lump Sum) for the respective payment periods. Adding Lump Sum Payments: On the 13 th and 17 th periods, let’s add two lump sum payments, $10,000 and $15,000, respectively.For “Monthly” Extra Payment Frequency, you cannot choose Weekly or Bi-weekly frequencies. You can also choose Bi-monthly, Quarterly, Semi-annually, Annually. Extra Payment Frequency: So, you want to add your extra payment ($200) every month.

So, in addition to your regular PMT payments, you want to pay an extra $200. Extra Amount You Plan to Add ($): 200.For different Interest Compounding Frequency & Regular Payment Frequency, Interest Compounding Frequency must be equal to or higher than the frequency of the Regular Payment. This is the normal case: Regular Payment Frequency will be the same as the Interest Compounding Frequency.

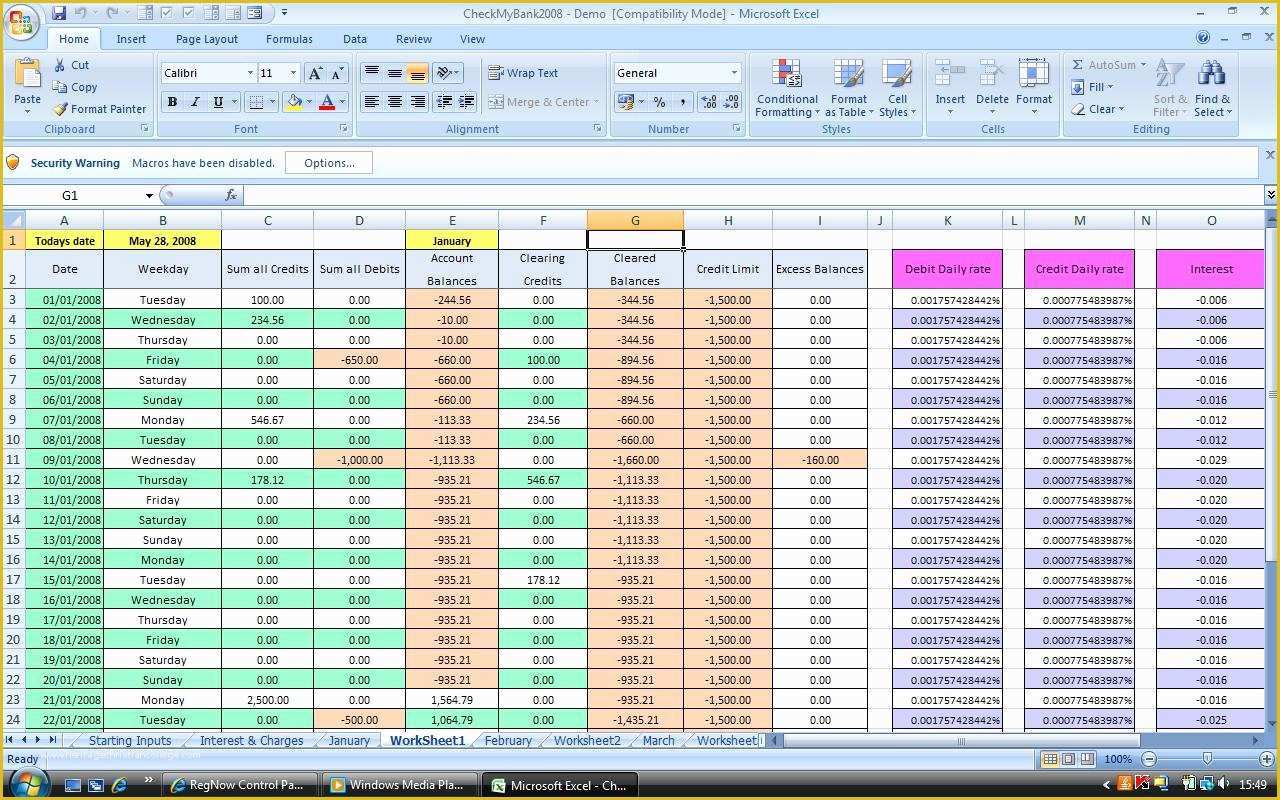

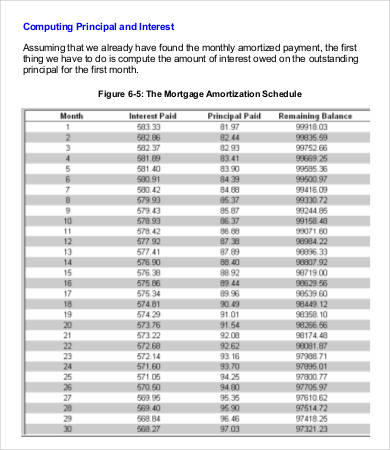

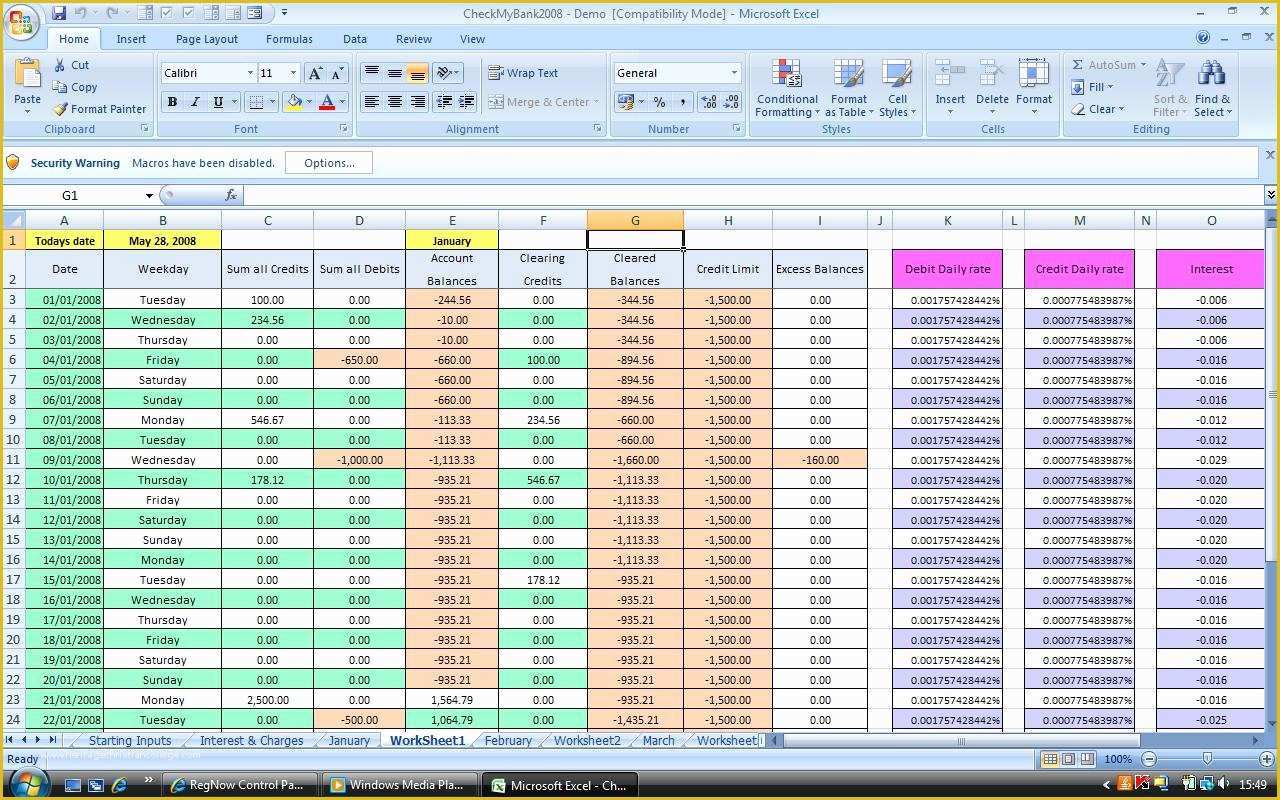

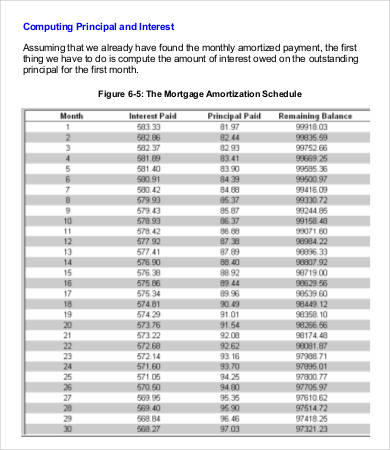

Interest Compounding Frequency: Monthly. Regular Payment Frequency: It means you pay your regular payments every month. Remaining Years: 28.50, It means you have already paid the regular payments for the period 30-28.50 = 1.5 years. Suppose you have loan details like the following: Let me show you the use of this template with an example. You can choose a different payment frequency for your extra recurring payments. In some countries, for example, Canada, payment frequency and interest compounding frequency can be different. You can choose your Interest Compounding Frequency. Time saved (if you made recurring extra payments or irregular/lump sum extra payments). Estimated interest savings (if you made recurring extra payments or irregular/lump sum extra payments). The total amount paid over the lifetime of the loan. The template will show you the following outputs:

Interest Compounding Frequency: Monthly. Regular Payment Frequency: It means you pay your regular payments every month. Remaining Years: 28.50, It means you have already paid the regular payments for the period 30-28.50 = 1.5 years. Suppose you have loan details like the following: Let me show you the use of this template with an example. You can choose a different payment frequency for your extra recurring payments. In some countries, for example, Canada, payment frequency and interest compounding frequency can be different. You can choose your Interest Compounding Frequency. Time saved (if you made recurring extra payments or irregular/lump sum extra payments). Estimated interest savings (if you made recurring extra payments or irregular/lump sum extra payments). The total amount paid over the lifetime of the loan. The template will show you the following outputs:  Depositing irregular / lump-sum payments when you are able. Calculating your regular payments (PMT). You can use this calculator in three ways: We can assure you that this is the most versatile Excel calculator for a mortgage loan. Let me explain the terminology and usage of this template. We have developed an Excel template that will be the best tool in your journey to becoming debt-free. From Warren Buffet to Ray Dalio, all big investors emphasize living beyond your means and saving the rest. From big countries to small businesses, all are sunk in debt. Using Mortgage/Loan Calculator with Extra Payments & Lump Sum in Excelīecoming a debt-free person is the best blessing in this age of the debt. Creating Mortgage Calculator with Lump Sum.xlsx

Depositing irregular / lump-sum payments when you are able. Calculating your regular payments (PMT). You can use this calculator in three ways: We can assure you that this is the most versatile Excel calculator for a mortgage loan. Let me explain the terminology and usage of this template. We have developed an Excel template that will be the best tool in your journey to becoming debt-free. From Warren Buffet to Ray Dalio, all big investors emphasize living beyond your means and saving the rest. From big countries to small businesses, all are sunk in debt. Using Mortgage/Loan Calculator with Extra Payments & Lump Sum in Excelīecoming a debt-free person is the best blessing in this age of the debt. Creating Mortgage Calculator with Lump Sum.xlsx

0 kommentar(er)

0 kommentar(er)